Energy finance and sustainable development

Sustainable development, the concept of meeting present needs without compromising future generations, has gained prominence in global discourse, particularly within emerging economies like the BRICS countries (Abbasi et al., 2024; Bashir et al., 2024; Merrill et al., 2017). These nations face the complex task of aligning economic growth with environmental and social sustainability. Energy finance is central to discussions on sustainable development. Fossil Fuel Energy Finance (FFEF) and Renewable Energy Finance (RNEF) represent two divergent approaches (Merrill et al., 2017). FEEF has historically driven economic growth by supporting infrastructure development and industrial activities (Bashir et al., 2024). However, this reliance on fossil fuels is increasingly scrutinized due to its significant environmental impact, contributing to climate change and resource depletion. Critics argue that continued investment in fossil fuels undermines long-term sustainability goals, highlighting the need for a transition towards cleaner energy sources (Baz et al., 2021).

Yadav et al. (2024) reveal that financial development, including domestic credit availability and consumer price stability, significantly drives renewable energy consumption across BRICS nations, though foreign direct investment exhibits a more complex, less predictable influence. In another contribution, Yadav (2025) emphasizes how renewable energy acts as a stabilizer in economically volatile regions, especially when moderated by trade openness and GDP per capita, suggesting that macroeconomic context shapes the risk-mitigation benefits of green energy transitions. Complementing this perspective, Yadav and Behera (2024) explore the intersection of ESG performance and investment decisions in India, finding that companies with strong ESG compliance not only outperform their peers in terms of stock returns but also contribute to broader climate objectives.

In contrast, RNEF is lauded for its alignment with sustainability objectives. Investments in renewable energy are crucial for reducing greenhouse gas emissions and promoting environmental conservation (Zhou and Li, 2022). Despite this, the transition from fossil fuels to renewables is fraught with challenges. These include high initial costs, technological barriers, and varying levels of policy support across countries (Xu et al., 2023). While RNEF supports long-term sustainability, its effectiveness is contingent on overcoming these barriers and achieving a balanced energy portfolio.

Bekun et al. (2024) reveal that in MINT countries, while renewable energy consumption positively impacts environmental sustainability—as measured by the Load Capacity Factor (LCF)—the current level of investment is insufficient to reverse ecological degradation, indicating an urgent need to transition from fossil-based to clean energy sources. In a complementary study, Bekun et al. (2024) highlight the environmental trade-offs of foreign direct investment (FDI) in South Asia, emphasizing the emergence of N-shaped Environmental Kuznets Curve (EKC) patterns and validating the pollution haven hypothesis. These findings suggest that FDI must be carefully channeled into green sectors to avoid exacerbating carbon emissions. Further extending the discourse, Yadav et al. (2024) demonstrate that in BRICS economies, renewable energy investments alone are not enough; their environmental benefits are significantly enhanced when supported by effective governance and strategic green finance. The study emphasizes the importance of policy coordination and long-term investment strategies that align renewable energy initiatives with institutional quality and financial innovation to achieve sustained CO₂ emission reductions and drive low-carbon transitions.

Despite the growing body of literature exploring the relationship between energy finance and sustainable development, there remains a notable gap in understanding how different configurations of energy financing—particularly the interplay between FFEF and RNEF—interact with institutional and technological enablers to shape sustainability outcomes, especially in the context of emerging economies. Existing studies often examine fossil and renewable energy finance in isolation or focus narrowly on environmental impacts without incorporating the broader financial and governance frameworks within which these investments occur.

Digital financial inclusion and sustainable development

Digital Financial Inclusion (DFIN) offers a promising avenue for enhancing sustainable development by broadening access to financial services (Yang and Zhang, 2020). On one hand, digital financial services can increase financial accessibility, facilitate investments in sustainable technologies, and foster economic participation (Lee et al., 2023). Financial inclusion has been linked to improved socio-economic outcomes, supporting broader sustainability efforts (Yang and Zhang, 2020). However, the impact of DFIN on sustainability is not uniformly positive. Critics point out that digital financial services often exacerbate existing inequalities if not accompanied by robust infrastructure and regulatory frameworks (Lee et al., 2023). Issues such as digital literacy, cybersecurity risks, and infrastructure deficits can limit the effectiveness of financial inclusion efforts in promoting sustainable development (Anakpo et al., 2023). Thus, while DFIN has potential, its impact is highly dependent on the surrounding socio-economic context.

While the existing literature acknowledges the role of digital financial inclusion in advancing economic and social aspects of sustainability, there is a limited understanding of how DFIN interacts with other structural factors—such as energy finance and governance accountability—to influence sustainable development outcomes, particularly in emerging economies like BRICS. Most prior studies tend to examine DFIN in isolation or focus primarily on micro-level impacts, such as individual or household financial behavior, without fully capturing its systemic role in national sustainability frameworks. Additionally, there is a dearth of comparative and configuration-based analyses that explore how the effectiveness of DFIN is shaped by institutional contexts, digital infrastructure readiness, and policy environments across different countries.

Governance accountability and sustainable development

Governance Accountability is another critical factor influencing sustainable development (Abhayawansa et al., 2021). Strong governance structures are essential for implementing effective sustainability policies, ensuring resource efficiency, and reducing corruption (Karlsson-Vinkhuyzen et al., 2018). High levels of accountability can enhance policy effectiveness and support the successful execution of sustainable development initiatives (Abhayawansa et al., 2021). Conversely, weak governance can undermine sustainability efforts by leading to inefficient resource use and lack of policy enforcement (Karlsson-Vinkhuyzen et al., 2018). The effectiveness of governance structures in promoting sustainability varies significantly across countries, influenced by factors such as institutional capacity, political stability, and public engagement. This variability underscores the need for context-specific approaches to governance that address local challenges and leverage opportunities for sustainable development.

The literature reveals that while individual factors such as energy finance, digital inclusion, and governance accountability are critical for sustainable development, their interactions are complex and context-dependent (Abbasi et al., 2024; Abhayawansa et al., 2021; Anakpo et al., 2023; Karlsson-Vinkhuyzen et al., 2018; Merrill et al., 2017). Fossil fuel investments, despite their immediate economic benefits, often conflict with long-term sustainability goals unless balanced by renewable energy investments and effective governance (Merrill et al., 2017). Similarly, while digital financial inclusion holds promise, its impact is contingent on addressing infrastructural and regulatory challenges (Lee et al., 2023). Governance accountability remains a pivotal enabler but is variable across contexts, influencing the overall effectiveness of sustainability strategies (Abhayawansa et al., 2021).

Synergistic effects on sustainable development

Sustainable development is inherently multidimensional, requiring coordinated action across economic, environmental, and institutional spheres. While individual components such as energy finance, digital financial inclusion, and governance accountability have been recognized as critical drivers of sustainability, their isolated analysis often overlooks the compounded impact that arises when these factors interact. The concept of synergistic effects refers to the amplified or emergent outcomes that occur when multiple variables interact in a complementary manner, producing a greater combined effect than the sum of their individual contributions (Xia et al., 2025; Rahman, 2025). In the context of sustainable development, such synergy is vital, as the challenges involved—climate change mitigation, equitable growth, and institutional resilience—are interlinked and cannot be addressed in silos.

When energy finance—particularly a balanced mix of fossil fuel and renewable investments—is integrated with digital financial inclusion, the financial resources required for clean energy adoption become more accessible to households, businesses, and local governments. This financial democratization can accelerate investment in sustainable technologies, especially in underserved or remote regions where traditional banking systems are limited (Zhou & Li, 2022). Simultaneously, robust governance accountability ensures that these financial flows are transparent, efficient, and aligned with national sustainability goals. Strong institutions play a supervisory role in guiding energy policy, regulating digital finance ecosystems, and enforcing environmental compliance .

Moreover, these interactions can mutually reinforce each other. For example, digital platforms can enhance governance through real-time monitoring of energy subsidies and investment flows, thereby reducing corruption and increasing policy responsiveness (Anakpo et al., 2023). Likewise, effective governance can foster investor confidence and spur private sector participation in renewable energy projects, particularly when supported by inclusive digital financial tools. Thus, the synergistic effect of energy finance, DFIN, and GAB creates a reinforcing loop that strengthens institutional capacity, accelerates energy transition, and promotes financial equity—key pillars of sustainable development.

Understanding and leveraging these synergistic relationships is essential for policymakers, especially in emerging economies like the BRICS, where development pressures are acute, and resources are often constrained. By adopting a holistic, systems-thinking approach that embraces these interdependencies, nations can unlock more resilient, inclusive, and environmentally responsible development trajectories.

Theoretical framework

This study is grounded primarily in Ecological Economics Theory, which posits that economic systems are subsystems of the larger ecological environment and must operate within the planet’s biophysical limits (Costanza et al., 1997). Unlike traditional neoclassical economics, which treats the environment as an externality, ecological economics integrates environmental sustainability, social equity, and economic development into a cohesive framework. In the context of BRICS countries, where rapid economic growth often strains ecological resources, this theory provides a valuable lens for analyzing how different types of energy finance—particularly the balance between fossil fuel energy finance and renewable energy finance—impact long-term sustainable development. The framework underscores the importance of aligning financial flows with environmental boundaries and supports the inclusion of digital financial inclusion as a mechanism to democratize access to sustainable investments.

To complement this ecological lens, the study also draws on Institutional Theory, which emphasizes the role of formal rules, regulatory systems, and governance structures in shaping organizational and societal outcomes (North, 1990). Governance accountability is a critical institutional factor in ensuring that financial mechanisms—be they in energy or digital domains—are effectively regulated, transparent, and aligned with public interest. Institutional theory helps explain how diverse governance capacities across BRICS countries influence the success of sustainability initiatives. It also supports the idea that well-functioning institutions can enhance the efficiency of DFIN and direct energy investments towards more sustainable pathways. The integration of these two theories allows for a multidimensional analysis that captures both the ecological constraints and institutional dynamics driving sustainable development in emerging economies.

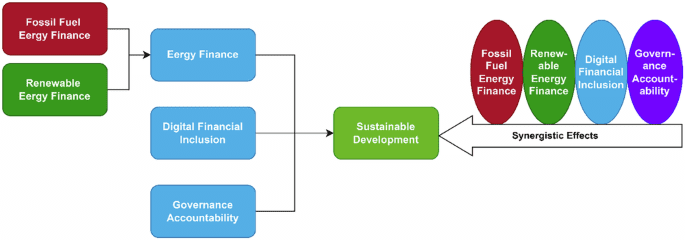

Figure 1 conceptually illustrates the dynamic interrelationship among key financial, technological, and institutional variables influencing sustainable development in the BRICS countries. The model positions FFEF and RNEF as two core forms of energy finance with contrasting implications: while FFEF supports traditional industrial and energy infrastructure, RNEF is oriented toward environmentally sustainable energy transitions. Digital Financial Inclusion acts as a financial enabler, expanding access to capital and services that support both energy investments and inclusive economic growth. Governance Accountability functions as a regulatory and institutional mechanism that ensures transparency, efficient allocation of financial resources, and alignment with sustainability objectives.

What distinguishes this framework is the inclusion of synergistic effects, represented in the figure by intersecting pathways or interactive nodes. These synergies highlight how the combined influence of multiple factors—such as the co-existence of strong governance and high DFIN, or the integration of both RNEF and FFEF within a digitally inclusive and accountable system—can produce greater impacts on sustainable development than the sum of individual contributions. For instance, high RNEF coupled with robust governance and digital access may accelerate clean energy adoption more effectively than RNEF alone. The figure thus conveys that sustainable development in emerging economies is not driven by isolated factors but rather by the integrated and interactive functioning of financial flows, digital access, and institutional strength. Based on the existing study review, this study develops the Fig. 1.