‘Wildfire Prepared’ offers path to make homes safer — and more insurable — as wildfire risk grows

By Steve Mitchell, Ashland.news

Wildfire experts from a nonprofit that helps people harden their homes from wildfire, which helps keep their insurance premiums from rising, joined local leaders and residents during a Thursday, Aug. 21, webinar to share their latest findings on how homes ignite during wildfires—and how to prevent it from happening in Ashland.

The webinar, hosted by Ashland city officials and Ashland.news, dubbed “Making Our Homes More Survivable and Insurable Against Wildfire,” featured two representatives from the Insurance Institute for Business and Home Safety (IBHS), an independent South Carolina-based nonprofit that is backed by major insurers across the country.

In May, Gov. Tina Kotek announced a partnership between the Oregon state fire marshal and IBHS. IBHS oversees the “Wildfire Prepared” program. The program allows homeowners in Oregon and California to receive certificates for undertaking particular home hardening and fire prevention efforts around their homes. Insurers could then take those certifications into their calculations for setting rates and premiums.

Brian Hendrix, Ashland Fire & Rescue’s Fire Adapted Communities coordinator, said insurance rates and the availability of coverage have “quickly become a significant issue” in Ashland, around the state, and the country.

Hendrix added that the Thursday discussion was about much more than just insurance; it was about “resiliency” and rallying the community — tenants, landlords, those who work in real estate and landscaping — around a collective effort to better prepare Ashland for a wildfire.

Evan Sluder, a research engineer with IBHS, said the organization’s work studies how embers, radiant heat, and direct flame threaten structures. Research teams with IBHS recreate severe weather and observe weak links in structures, understand how failures occur, and learn what people can do to prevent them.

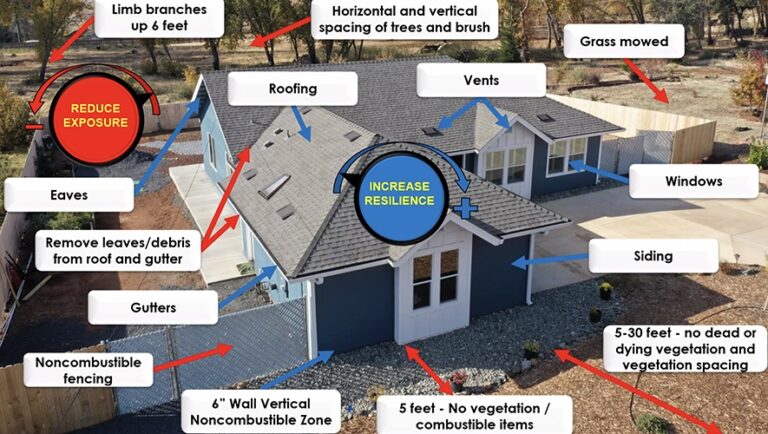

At the heart of IBHS’ message was the critical role of creating a “defensible space” — a 5-foot buffer around a home or structure with no combustible material, including trees, hanging branches, yard debris, mulch, and plastics, among others.

By removing combustible materials within the first 5 feet of a home and managing vegetation up to 30 feet out, residents can break the chain of fire spread, Sluder said.

“Zone zero, the area closest to the house, is the backbone of reducing potential exposure,” said Sluter. “No combustibles permitted in this zone means a vital break for fire spread,” Sluder said.

Hardening homes in Ashland

During the discussion portion of the webinar, the conversation touched on the challenges of adapting existing neighborhoods to new fire safety standards.

The risk posed by traditional wood fencing came up. Hendrix said the city does not issue permits for such fences, given how combustible they are. Enforcement, he said, is largely “complaint-driven,” he said.

The panel recommended replacing wood with metal fencing, especially in critical zones that are closest to the home, to stop a fire from spreading through neighborhoods.

Hendrix said that plans are underway to update the city’s codes and explore financial assistance programs for people to upgrade and harden their homes, including replacing wood with metal fencing.

Getting a home certified

Steve Hawks, the senior director of wildfire with IBHS, said the first thing someone should do to begin the certification process is to download a checklist from the “Wildfire Prepared” website. He said to follow the list closely and evaluate the structure closely to the requirements listed in the document. Once the work is completed, apply for the certification online, which costs $125.

Only single-family homes up to three stories can be certified, and the process must be started by the owner of the home, according to the website. Apartment buildings, townhomes, and multiplexes are not eligible, and the process cannot be started by the renter.

Insurance questions

Hawks said that taking measures to harden homes makes getting insurance coverage more accessible. However, he said, each insurance company is its own individual company and makes decisions that are best for its business.

He said 80% of residential property and casualty insurers across the country back IBHS. Meantime, half of all business insurers are IBHS supporters. This means that they have directed IBHS to research how structures ignite during high-intensity fires and, from there, they develop the wildfire and neighborhood protection programs.

The data that IBHS collects makes it back to those companies that set the rates and premiums, he said.

“We certainly know that reducing the risk is the right measure to take,” he said. “We know that insurance companies are in the business to write insurance, and they want to write what they view as good risk, not bad risk.”

When a community of homeowners has taken steps to mitigate risks, they have made it attractive to insurers, Hawks said.

Email Ashland.news associate editor Steve Mitchell at [email protected].

Related stories:

Ashland’s draft Wildfire Protection Plan emphasizes community involvement (Aug. 18)

‘What’s your plan?’: Ashlanders learn about evacuation readiness during interactive wildfire preparedness event (July 18)

Experts offer tips to protect homes wildfire (May 17)